Every year, Media Services highlights some of the key changes facing our industry. While this spotlight does not provide legal advice, it does seek to alert our clients to the myriad of issues and challenges arising in our industry.

This year we included things like minimum wage increases, federal tax and retirement limits, and state loan-out withholding rates. If you have any questions or would like to learn more, connect with us at [email protected].

2023 Minimum Wage by State for Production Crews

| State | 2022 Rate (per hour) | Effective Date |

| Alabama | $7.25 | |

| Alaska | $10.85 | 1/1/23 |

| Arizona | $13.85 | 1/1/23 |

| Arkansas | $11.00 | 1/1/21 |

| California – Small Employers (25 or fewer employees) | $15.50 | 1/1/23 |

| California – Large Employers (26 or more employees) | $15.50 | 1/1/23 |

| Colorado | $13.65 | 1/1/23 |

| Connecticut | $14.00 | 7/1/22 |

| Delaware | $11.75 | 1/1/23 |

| Florida | $11.00 | 9/30/22 |

| Georgia | $7.25 | |

| Hawaii | $12.00 | 10/1/22 |

| Idaho | $7.25 | |

| Illinois | $13.00 | 1/1/23 |

| Indiana | $7.25 | |

| Iowa | $7.25 | |

| Kansas | $7.25 | |

| Kentucky | $7.25 | |

| Louisiana | $7.25 | |

| Maine | $13.80 | 1/1/23 |

| Maryland – 14 or fewer employees | $12.80 | 1/1/23 |

| Maryland – 15 or more employees | $13.25 | 1/1/23 |

| Massachusetts | $15.00 | 1/1/23 |

| Michigan | $10.10 | 1/1/23 |

| Minnesota – Small Employers (100 or fewer employees) | $8.63 | 1/1/23 |

| Minnesota – Large Employers (101 or more employees) | $10.59 | 1/1/23 |

| Mississippi | $7.25 | |

| Missouri | $12.00 | 1/1/23 |

| Montana | $9.95 | 1/1/23 |

| Nebraska | $10.50 | 1/1/23 |

| Nevada – employers who do provide employee benefits | $9.50 | 7/1/22 |

| Nevada – employers who do not provide employee benefits | $10.50 | 7/1/22 |

| New Jersey – Large Employers (6 or more employees) | $14.13 | 1/1/23 |

| New Jersey – Small Employers (fewer than 6 employees) and seasonal employees | $12.93 | 1/1/23 |

| New Hampshire | $7.25 | |

| New Mexico | $12.00 | 1/1/23 |

| New York | $14.20 | 12/31/22 |

| North Carolina | $7.25 | |

| North Dakota | $7.25 | |

| Ohio | $10.10 | 1/1/23 |

| Oklahoma | $7.25 | |

| Oregon (standard) | 13.50 | 7/1/22 |

| Oregon (Portland Metro) | $14.75 | 7/1/22 |

| Oregon (Nonurban Counties) | $12.50 | 7/1/22 |

| Pennsylvania | $7.25 | |

| Puerto Rico | $8.50 | 1/1/22 |

| Rhode Island | $13.00 | 1/1/23 |

| South Carolina | $7.25 | |

| South Dakota | $10.80 | 1/1/23 |

| Tennessee | $7.25 | |

| Texas | $7.25 | |

| Utah | $7.25 | |

| Vermont | $13.18 | 1/1/23 |

| Virginia | $12.00 | 1/1/23 |

| Washington | $15.74 | 1/1/23 |

| West Virginia | $8.75 | |

| Wisconsin | $7.25 | |

| Wyoming | $7.25 |

2023 Minimum Wage Rates in Localities for Production

These localities have minimum wage requirements that are different or higher than the state or federal minimum wage, or they will in 2023:

| Locality | 2022 rate (per hour) | Effective Date |

| Flagstaff, AZ | $16.80 | 1/1/23 |

| Tucson, AZ | $13.85 | 1/1/23 |

| Alameda, CA | $15.75 | 1/1/22 |

| Belmont, CA | $16.75 | 1/1/23 |

| Berkeley, CA | $16.99 | 7/1/22 |

| Burlingame, CA | $16.47 | 1/1/23 |

| Cupertino, CA | $17.20 | 1/1/23 |

| Daly City, CA | $16.07 | 1/1/23 |

| El Cerrito, CA | $17.35 | 1/1/23 |

| Emeryville, CA | $17.68 | 7/1/22 |

| East Palo Alto, CA | $16.50 | 1/1/23 |

| Foster City, CA | $16.50 | 1/1/23 |

| Fremont, CA – Large Employers (26 or more employees) | $16.00 | 7/1/22 |

| Fremont, CA – Small Employers (25 or fewer employees) | $16.00 | 7/1/22 |

| Halfmoon Bay, CA | $16.45 | 1/1/23 |

| Hayward, CA – 26 or more employees | $16.34 | 1/1/23 |

| Hayward, CA – 25 or fewer employees | $15.50 | 1/1/23 |

| Los Altos, CA | $17.20 | 1/1/23 |

| Los Angeles City, CA | $16.04 | 7/1/22 |

| Los Angeles County, CA– Small Employers (25 or fewer employees) | $15.96 | 7/1/22 |

| Los Angeles County, CA – Large Employers (26 or more employees) | $15.96 | 7/1/22 |

| Malibu, CA – Small Employers (25 or fewer employees) | $15.96 | 7/1/22 |

| Malibu, CA – Large Employers (26 or more employees) | $15.96 | 7/1/22 |

| Menlo Park, CA | $16.20 | 1/1/23 |

| Milpitas, CA | $16.40 | 7/1/22 |

| Mountain View, CA | $18.15 | 1/1/23 |

| Novato, CA – 100 or more employees | $16.32 | 1/1/23 |

| Novato, CA – 26-99 employees | $16.07 | 1/1/23 |

| Novato, CA – 25 employees or less | $15.53 | 1/1/23 |

| Oakland, CA | $15.97 | 1/1/23 |

| Palo Alto, CA | $17.25 | 1/1/23 |

| Pasadena – Small Employers (25 or fewer employees) | $16.11 | 7/1/22 |

| Pasadena – Large Employers (26 or more employees) | $16.11 | 7/1/22 |

| Petaluma, CA | $17.06 | 1/1/23 |

| Redwood City, CA | $17.00 | 1/1/23 |

| Richmond, CA | $16.17 | 1/1/23 |

| San Carlos, CA | $16.32 | 1/1/23 |

| San Diego, CA | $16.30 | 1/1/23 |

| San Francisco, CA | $16.99 | 7/1/22 |

| South San Francisco, CA | $16.70 | 1/1/23 |

| San Jose, CA | $17.00 | 1/1/23 |

| San Leandro, CA | $15.50 | 1/1/23 |

| San Mateo, CA | $16.75 | 1/1/23 |

| Santa Clara, CA | $17.20 | 1/1/23 |

| Santa Monica, CA – Small Employers (25 or fewer employees) | $15.96 | 7/1/22 |

| Santa Monica, CA – Large Employers (26 or more employees) | $15.96 | 7/1/22 |

| Santa Rosa, CA | $17.06 | 1/1/23 |

| Sonoma, CA – 25 or fewer employees | $16.00 | 1/1/23 |

| Sonoma, CA – 26 or more employees | $17.00 | 1/1/23 |

| Sunnyvale, CA | $17.95 | 1/1/23 |

| West Hollywood, CA (49 or fewer employees) | $17.00 | 1/1/23 |

| West Hollywood, CA (50 or more employees) | $17.50 | 1/1/23 |

| Denver, CO | $17.29 | 1/1/23 |

| District of Columbia | $16.10 | 7/1/22 |

| Chicago, Ill – 21 or more employees | $15.40 | 7/1/22 |

| Chicago, Ill – 4-20 employees | $14.50 | 7/1/22 |

| Cook County, Ill | $13.35 | 7/1/22 |

| Portland, ME | $14.00 | 1/1/23 |

| Rockland, ME | $14.00 | 1/1/23 |

| Howard County, MD – 14 or fewer employees | $13.25 | 1/1/23 |

| Howard County, MD – 15 or more employees | $15.00 | 1/1/23 |

| Montgomery County, MD – Small Employers (10 or fewer employees) | $14.00 | 7/1/22 |

| Montgomery County, MD – Medium Employers (11-50 employees) | $14.50 | 7/1/22 |

| Montgomery County, MD – Large Employers (51 or more employees) | $15.65 | 7/1/22 |

| Minneapolis, MN – Small Employers (100 or fewer employees) | $14.50 | 7/1/23 |

| Minneapolis, MN – Large Employers (101 or more employees) | $15.19 | 1/1/23 |

| St. Paul, MN – Macro Employers more than 10,000 Employees | $15.19 | 1/1/23 |

| St. Paul, MN – Large Employers 101 – 10,000 Employees | $15.00 | 7/1/23 |

| St. Paul, MN – Small Employers 6-100 Employees | $13.00 | 7/1/23 |

| St. Paul, MN – Micro Employers 5 or fewer employees | $11.50 | 7/1/23 |

| Albuquerque, NM – employers who provide employee benefits | $12.00 | 1/1/23 |

| Albuquerque, NM – employers who do not provide employee benefits | $12.00 | 1/1/23 |

| Bernalillo County, NM | $12.00 | 1/1/23 |

| Las Cruces, NM | $12.00 | 1/1/23 |

| City of Santa Fe, NM | $14.03 | 3/1/23 |

| Santa Fe County, NM | $14.03 | 3/1/23 |

| New York City | $15.00 | 2019 |

| Long Island & Westchester, NY | $15.00 | 12/31/21 |

| Portland Metro, OR | $14.75 | 7/1/22 |

| SeaTac, WA | $19.06 | 1/1/23 |

| Seattle, WA – Small Employers with benefits (500 or fewer employees) | $16.50 | 1/1/23 |

| Seattle, WA – Small Employers without benefits (500 or fewer employees) | $18.69 | 1/1/23 |

| Seattle, WA – Large Employers (501 or more employees) | $18.69 | 1/1/23 |

IRS Mileage Rate for Film Productions in 2023

On December 29, 2022, the Internal Revenue Service issued optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. Production accountants can use these rates for budgeting their 2023 deductible mileage expenses on film and TV productions.

Beginning January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is:

- 65.5 cents per mile for business purposes

- 22 cents per mile for medical or moving purposes

- 14 cents per mile for charitable purposes

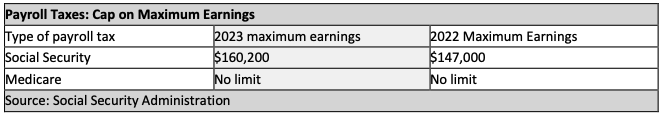

Social Security Payroll Tax Ceilings Increase for 2023

Starting January 1, 2023, the maximum earnings subject to the Social Security payroll tax will increase by $13,200 to $160,200—up from the $147,000 maximum for 2021, the Social Security Administration (SSA) announced Oct. 13.

The SSA also posted a fact sheet summarizing the 2023 changes. The taxable wage cap is subject to an automatic cost-of-living adjustment (COLA) each year based on increases in the national average wage index, calculated annually by the SSA.

401(k) Limits for 2023

The IRS recently announced that the 2023 contribution limit for 401(k) plans will increase by $2,000, to $22,500, up $20,500 from 2022.

- The 401(k)-contribution limit is $22,500

- The 401(k) catch-up contribution limit has increased to $7,500 for those ages 50 and older

Hawaii’s loan-out withholding rate, 2023

Effective on January 1, 2023, in Hawaii, all payments made to loan-out companies are subject to a withholding amount of 4% for services in Maui County, or 4.5% for services in any other Hawaiian county.

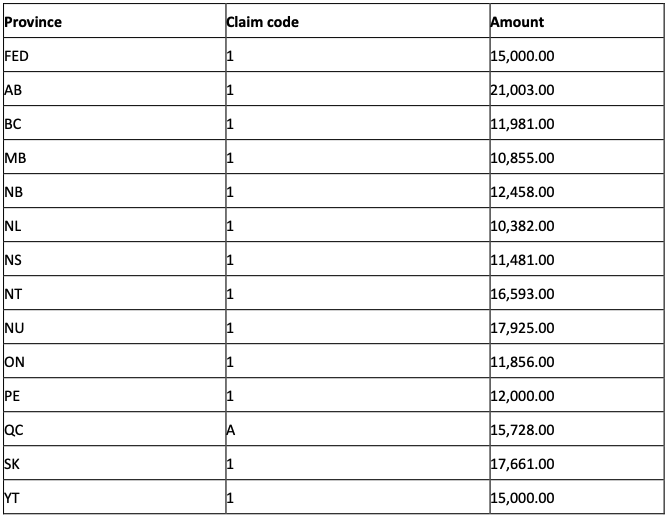

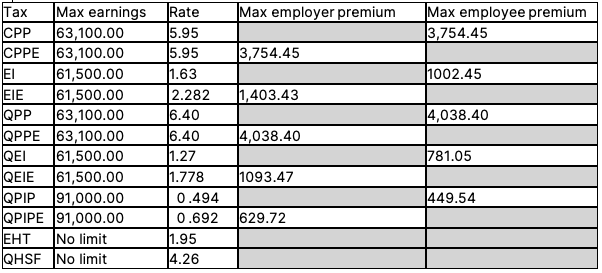

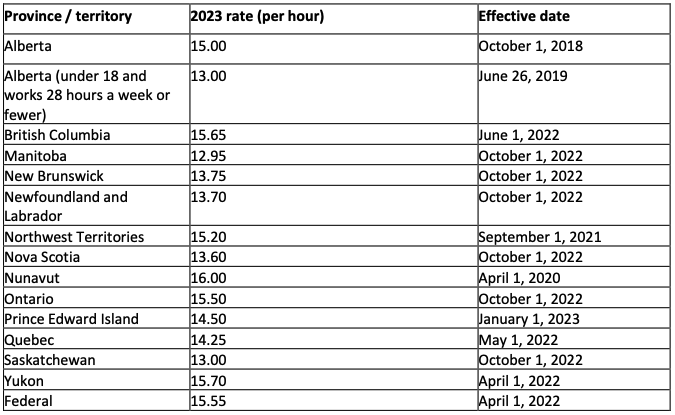

What’s New Across Canada

Claims Codes

CCP/EI Limits and More

Provincial Minimum Wages

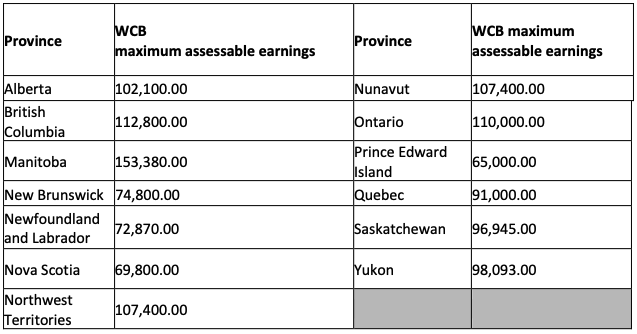

WCB Maximum Assessable Earnings

Loading...

Loading...