Earlier this month, the U.S. Supreme Court decided to hear King v. Burwell, a case involving a challenge to the IRS’s interpretation of insurance subsidies under the Affordable Care Act. The issue is whether subsidies are available to those in states that have not created an insurance exchange. The IRS took the position that subsidies are available through either state or federal exchanges. If the Supreme Court strikes down the IRS’s interpretation, arguably, individuals and employers in states without an exchange will not be subject to the ACA’s mandate. However, employers and individuals in states that have an exchange (like CA and NY) will still be subject to the ACA’s mandate.

The fact that the Supreme Court decided to hear the King case came as a surprise as it generally does not do so unless the Courts of Appeals have issued conflicting decisions. The D.C. Circuit has agreed to re-hear a case raising the same question, so there is not currently a clear split. The case will be heard before the end of the Supreme Court’s term in June 2015. The effect of its decision on the ACA will not be clear until the Court has made its ruling.

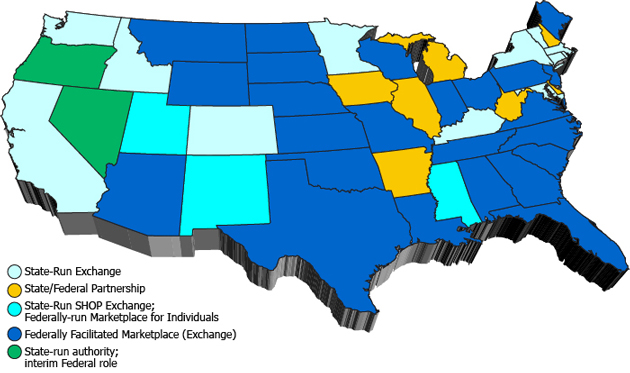

Below is a depiction of some of the states that have made their own exchanges. More information about the ACA can be found on Media Service’s website.

Loading...

Loading...